EOBI Verification Check Online 2024

Checking your EOBI verification is important to make sure you’re enrolled properly in the program. Knowing your EOBI status helps you understand your pension and insurance benefits. Using the online portal makes it easy to check your EOBI verification anytime.

Whether you’re retired or still working, keeping an eye on your EOBI status is key for your future benefits. In this guide, we’ll explain EOBI verification in simple terms through the steps, and highlight why it’s important to keep your information updated. Keep reading to find out more about EOBI verification!

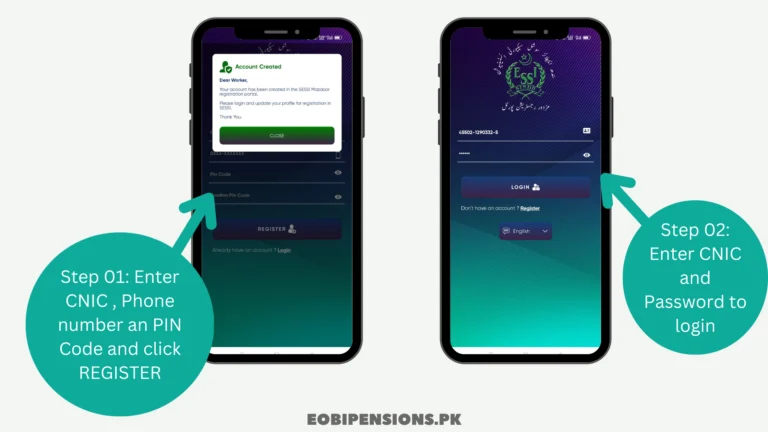

EOBI Registration Check Online by CNIC

If you want to check your EOBI registration using your CNIC online, follow these easy steps:

- Go to the Website Visit www.eobi.gov.pk.

- Look for the login section on the website.

- Enter your CNIC number to access your account. If you haven’t signed up yet, you’ll need to do that first.

What is EOBI and What are Its Benefits?

The Employees’ Old-Age Benefits Institution (EOBI) is a government agency in Pakistan that helps private-sector workers with benefits when they retire, become disabled, or pass away. Created in 1976, EOBI’s goal is to give workers and their families financial help when they need it.

Introduced in 1976 under Prime Minister Zulfikar Ali Bhutto’s government, the program is now managed by the Ministry of Overseas Pakistani and Human Resource Development. It operates under Article 38(c) and provides social and economic insurance to private-sector workers.

The program was set up to support private-sector employees who couldn’t get pensions when they retired, unlike government workers who received pensions after retirement.

EOBI provides various benefits like pensions for old age, disability, and survivors, as well as money for funeral costs. Both employees and employers put money into the EOBI fund. This money grows over time, creating a fund that pays out benefits to eligible workers when they need them.

EOBI’s benefits give workers a financial safety net, ensuring they have support during retirement, if they become disabled, or in case of death. It also encourages employers to care for their workers, making sure they are looked after throughout their working lives and beyond.

How do I submit EOBI online?

EOBI now offers an online payment option for registered employers. This means you can pay your EOBI contributions online instead of going to the bank. Here’s how to do it:

Steps to Pay Online:

- Use the EOBI Facilitation System to create your online payment voucher.

- Visit your bank’s e-payment portal where you have an account.

- Use the voucher number from Step 1 as a reference number when transferring your contribution to EOBI’s bank account at Bank Alfalah. You can use either of these IBAN numbers: PK37ALFH0015001005051405 or 0015001005051405.

- Contact for Help:

- Email: [email protected]

- Phone: 0336-2180199

Note:

- Use the email and phone number above only for online payment issues.

- For general inquiries about employers, contributions, or pensions, call the EOBI Helpline at 08000 EOBI (3624) from 9:00 AM to 5:00 PM, Monday to Friday.

Registration Through EOBI Registered Employer

EOBI Registration Manually

- Get the EOBI registration form from a nearby EOBI office or download it from the EOBI website.

- Complete the form with correct details like your company’s name, address, contact info, and details of your employees.

- Get these documents ready:

- Your company’s registration papers (like NTN certificate, SECP registration)

- A list of your employees with their CNIC numbers, birth dates, and when they started working

- Your company’s bank account details

- Take your filled-out form and documents to the closest EOBI office.

- Pay the registration fee. The amount can change based on your company size and other things. Keep the receipt as proof.

- After EOBI processes your application, they’ll give you a receipt or a certificate showing you’re registered with EOBI.

- After you’re registered, make sure to keep good records of what you and your employees pay into EOBI.

EOBI Verification and Registration Rules & Regulations

How do I Check my EOBI Pension Balance?

- Go to the EOBI website.

- Find the “Online Services” or “Member Services” part.

- Click on “Pensioner’s Portal” or something like that.

- Type in your ID number or EOBI number.

- Add your birth date or phone number if they ask.

- Press enter or submit to see your pension details.

- Your pension amount will show up on the screen.

- Keep your login details secret for safety.

Eobi verification regulations 2007 pdf download

Conclusion

It’s important to know how to register and check EOBI for your future pension. You can check your EOBI status online using your CNIC or do it manually. EOBI gives many benefits to those who qualify, helping them financially when they retire. Follow our steps for online or manual registration to join this helpful program.

You can also download the EOBI rules for more information. If you have any questions or face any issues, feel free to ask in the comments. We care about the law governing EOBI, the Employees’ Old-Age Benefits Act, which establishes the framework for providing old-age benefits to employees in Pakistan. This law outlines the eligibility criteria, contribution rates, and benefits provided under the Employees’ Old-Age Benefits Institution (EOBI) scheme.out your financial future!